Net Metering Explained

In order to understand the financial aspects of a solar energy project, it helps to first understand net metering as a base-case.

Case Study Parameters

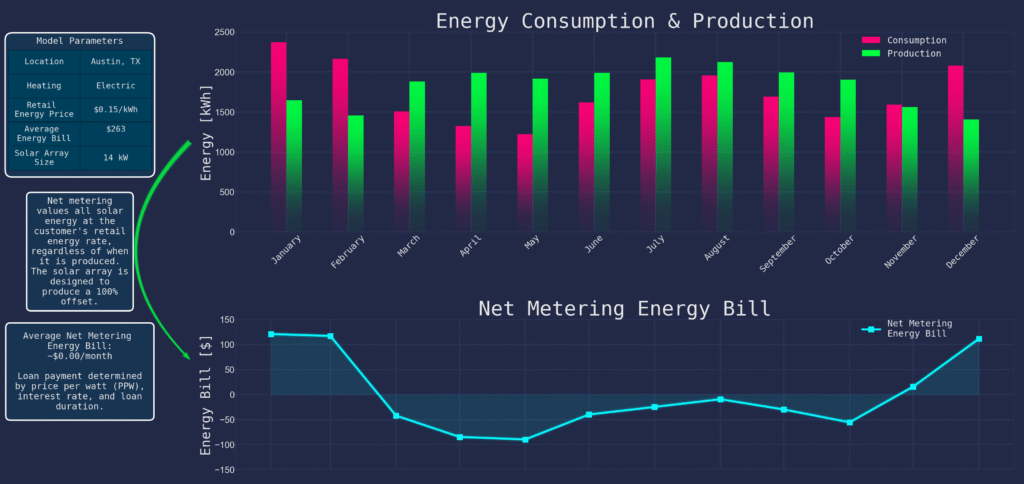

To explain it as quickly as possible, we take an imaginary household for an example. The energy consumption and production profiles are based on a single-family home in central Texas, with an electric heating system, and an unobstructed south-facing roof.

The household uses twenty-one thousand kilowatt hours of energy per year. At an energy price of fifteen cents per kilowatt hour, their average energy bill is $263.

A 14 kW solar array place on their roof can produce 21,000 kWh of solar energy per year, an amount equal to their consumption. This is a 100 percent offset. One caveat to this is that solar energy production varies over the course of the day, and throughout the seasons.

Net Metering Definition and Results

Typically, the rate of energy production exceeds consumption during the mid-day hours.

Similarly, solar energy production falls short of energy consumption in the winter, and a surplus of energy is produced in the summer.

With a net metering energy policy, all energy produced during the billing cycle is valued at the customer’s retail energy price, regardless of when it is produced.

In our current scenario, the property owner is able to obtain a net metering policy that also carries surplus energy bill credits forward to following months and pays out any remaining bill credit at the year’s end. In order to capitalize on this opportunity, they choose to install the 14 kW system.

One month’s surplus energy bill credit covers a deficit later in the year when production is low, and when their account is trued up at the end of the year, their average energy bill will be zero.

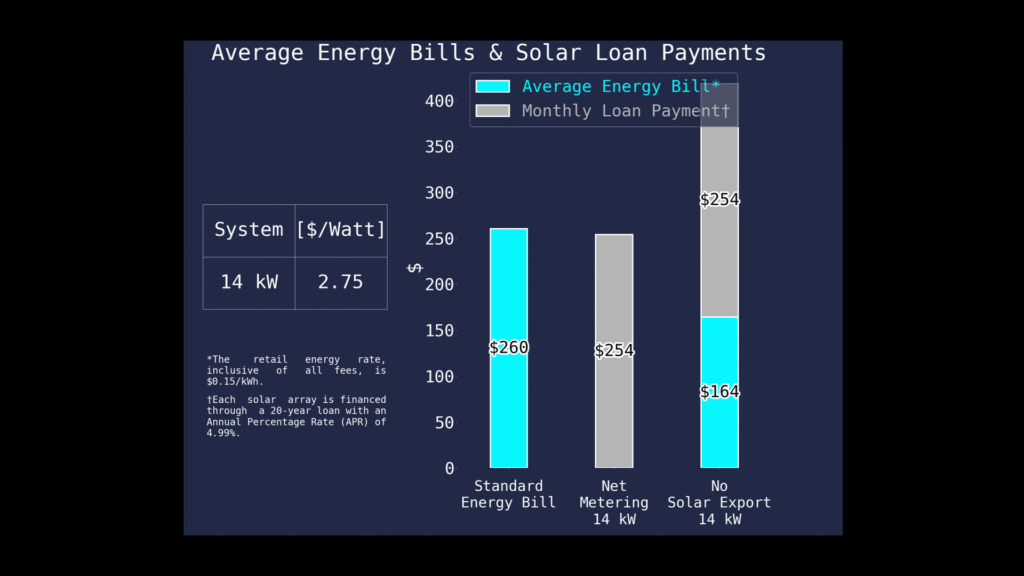

The 14 kW solar project costs $2.75 per watt and they finance this cost with a 20-year loan at a 5% APR. The loan payments of $254 each month are slightly lower than their average energy bill. Their energy bill has essentially been replaced with the cost of a solar energy project. (If a property owner is not compensated for excess solar energy production at all, a substantial portion of the energy bill would remain since the solar energy would only offset consumption during the daytime, when it is produced.)

Further Details that Determine Project Viability

Others might decide to pay cash for a similar system. In this case, the decision could be based on the internal rate of return (IRR) of the solar energy project. Regardless of whether the solar project is financed with a loan, or with cash, accounting for other factors such as system efficiency losses over time, and the costs of removing and re-installing a solar array when the roof is eventually replaced, makes these decisions more complicated. Expected energy price inflation also enters the equation.

One important trend to take note of is that net metering policies are being phased out. In some areas, they have never been available at all. In other areas, energy companies are now offering alternative policies, such as real time energy pricing, and time-of-use (TOU) energy plans.

To see how changes to the net metering scenario in this case study would impact the results, refer to our articles: Real Time Energy Pricing, IRR Calculation, and Other Factors to Consider. If you’re interested in energy storage, be sure to read Solar and Energy Storage without Net Metering and Solar + Energy Storage with Time of Use Energy Plans.