Real Time Energy Pricing Solar Array Optimization

Introduction

This article follows-up on our net metering case study. Oftentimes, people want to know what will happen if their net metering energy policy is replaced with something else. You might even have questions about a house with solar panels that you are considering buying. To find out how much value a solar array might produce for a homeowner that doesn’t have net metering as an option, read on.

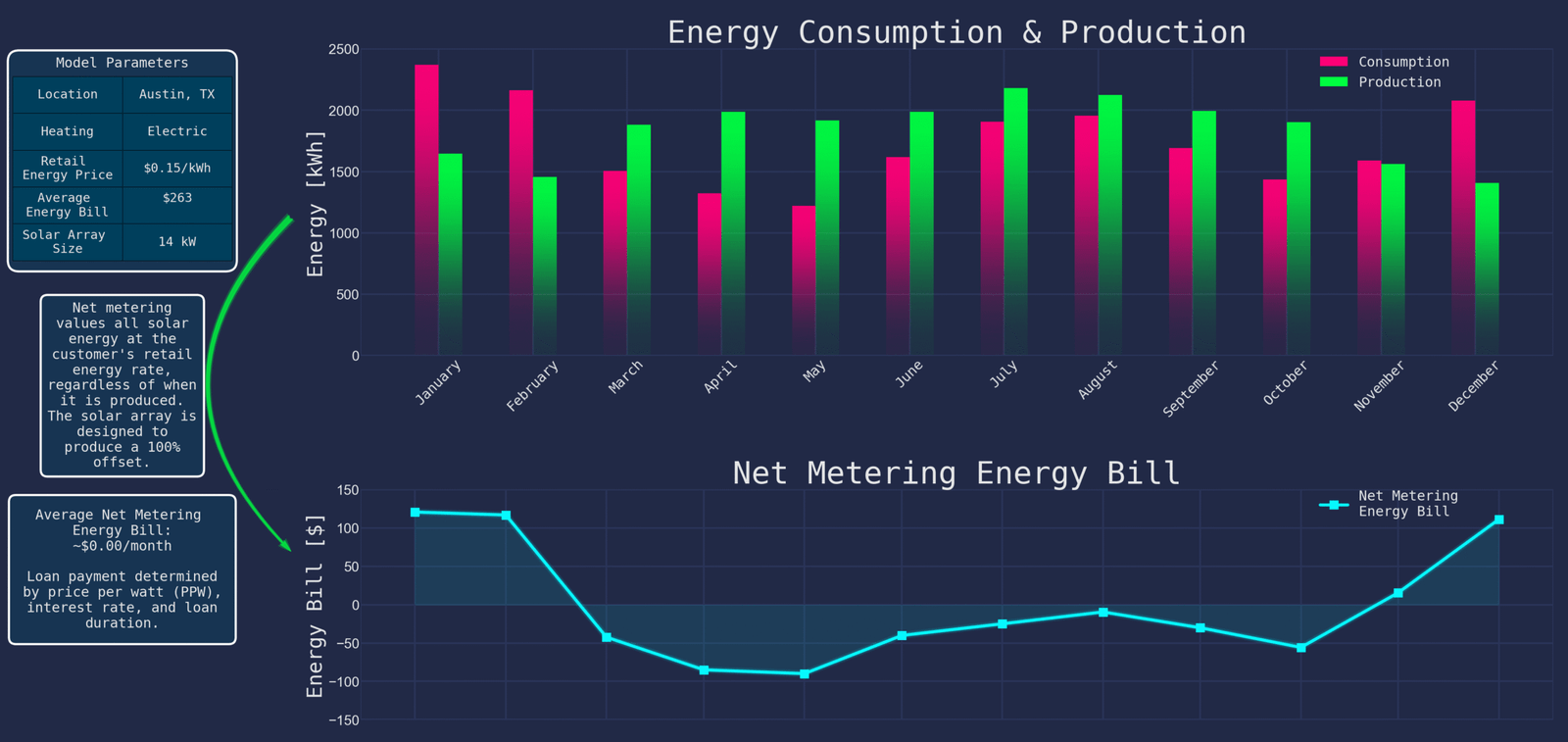

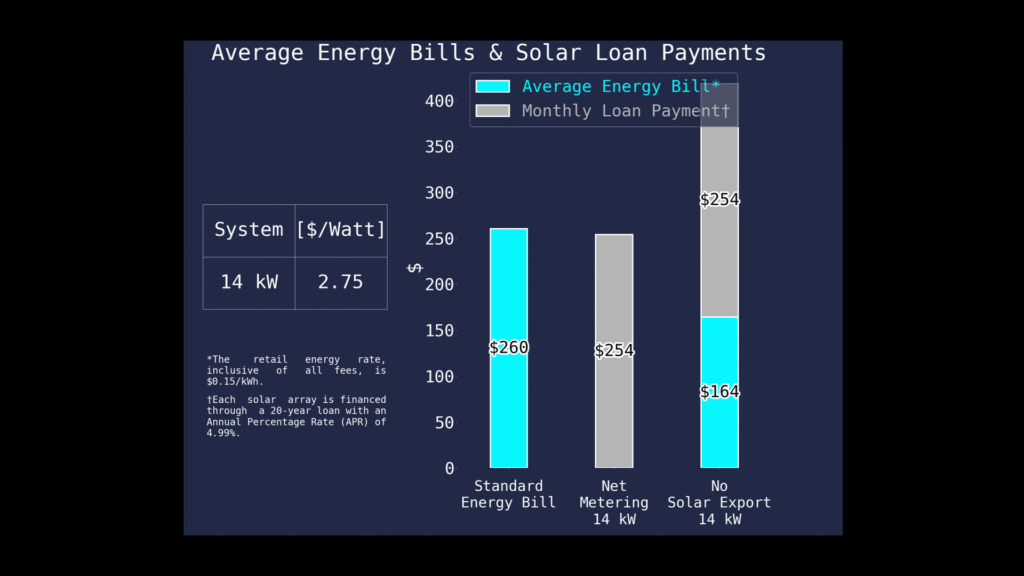

In this scenario, we will explore real time energy pricing. The energy consumption and production profiles here are exactly the same as in our net metering example, where a 14-kW array provided a 100% offset for the household’s 21,000 kWh of annual electricity consumption.

The outcome of the net metering case study was essentially the replacement of the energy bill with a 20-year loan consisting of monthly payments that were slightly lower than the average energy bill.

With net metering, excess solar energy is credited to the energy bill at the customer’s full retail price. A 100%-offset solar array results in an average energy bill of approximately $0.00. However, this is not the case with other energy policies. If an energy company does not reimburse their customer for surplus energy production at all, a substantial portion of their energy bill remains.

Many new energy plans are becoming available that land in the middle ground between these two extremes. One of them is real-time energy pricing.

Real Time Energy Pricing

Real-time energy pricing refers to energy plans in which excess solar energy production is valued at the current wholesale price at the moment it is produced. The wholesale price of energy varies throughout the day and is determined every fifteen minutes within the local energy market. Let’s take a look at a few days throughout the year as examples, to understand how market prices affect the energy bill. Then we will determine the viability of the solar energy project with real-time energy pricing based on a year-one analysis.

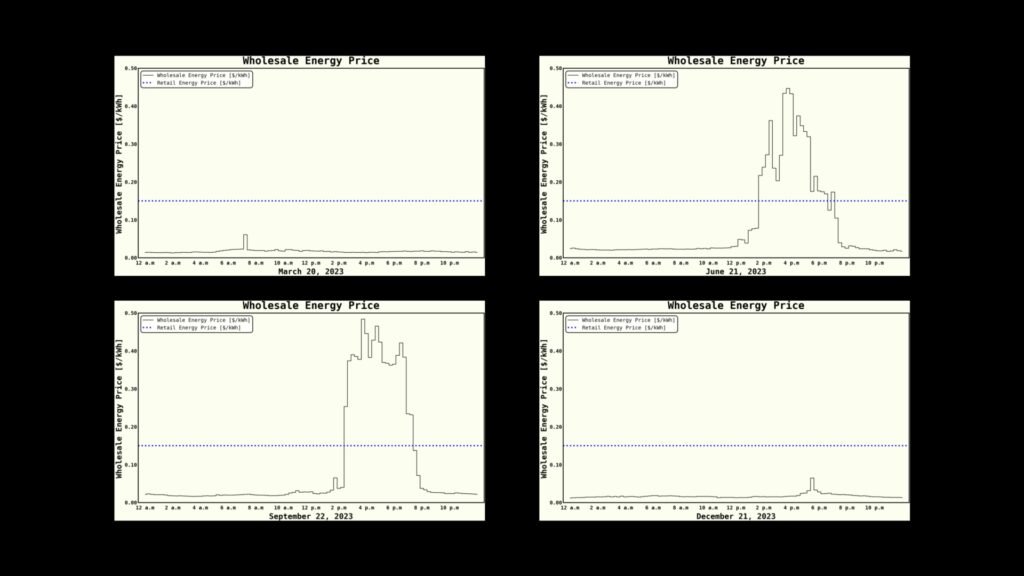

Here are a few examples of price charts that you might see for wholesale energy prices. These charts show historical wholesale energy price data in Austin, TX in 2023. The vernal equinox, summer solstice, autumnal equinox, and winter solstice were chosen for a side-by-side comparison since they illustrate the key concepts nicely (and it’s difficult to look at 365 24-hour price charts all at once).

Referring to the charts above, on March 20th, there is a trace of volatility. However, energy prices are consistently lower than the customer’s retail energy price of $0.15/kWh. (The chart for December 21st appears similar to this, while we see that June 21st and September 22nd experienced energy prices that exceeded the retail price by a considerable amount in the late afternoon.) The charts below reflect this in the increased value produced by the solar array:

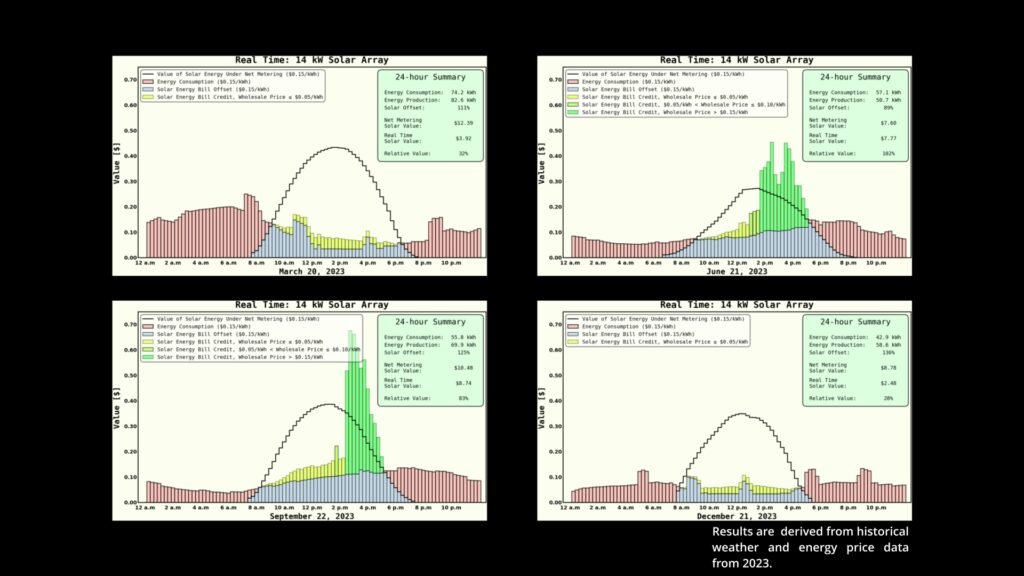

In the graphs above, The energy consumption that is paid for by the customer at their retail energy price appears in red. Energy consumption directly offset by solar energy appears in light blue; as with net metering, the customer pays nothing for this energy, so from their perspective, the value of this offset is $0.15/kWh. The value of excess solar energy sold at the current wholesale price appears in yellow (or green). (On March 20th, all excess solar energy was sold for less than $0.05/kWh.) Together, the bill offset and the bill credit add up to the value produced by the solar array with real-time pricing. For comparison, the potential value of solar energy produced under a net metering policy still appears as a solid black line.

The ratio of these two values represents the relative value of the solar project with real-time pricing compared to net metering. (The relative value for each day is visible in the 24-hour summary.)

For March 20th, relative value produced by the solar panels is only 32% of what it would be with a net metering policy. This is because the wholesale price of energy was relatively low, especially during the mid-day hours when excess solar energy was produced.

At other points in time, namely, June 21st and September 22nd, we see that volatility in wholesale energy prices can increase the value of surplus energy sold back to the grid. Looking at December 21st, we see that, similar to March 20th, the highest wholesale energy prices occurred at times when energy was not sold back to the grid.

So far, we have looked only at four days out of 365, and it is the cumulative effect of the entire year that matters.

Results

Accounting for the entire year, the wholesale price is usually lower than the customer’s retail energy rate, and because of this, the 14-kW array only covers a portion of the energy bill, despite producing a 100% offset. The overall relative value for the entire year is 58%.

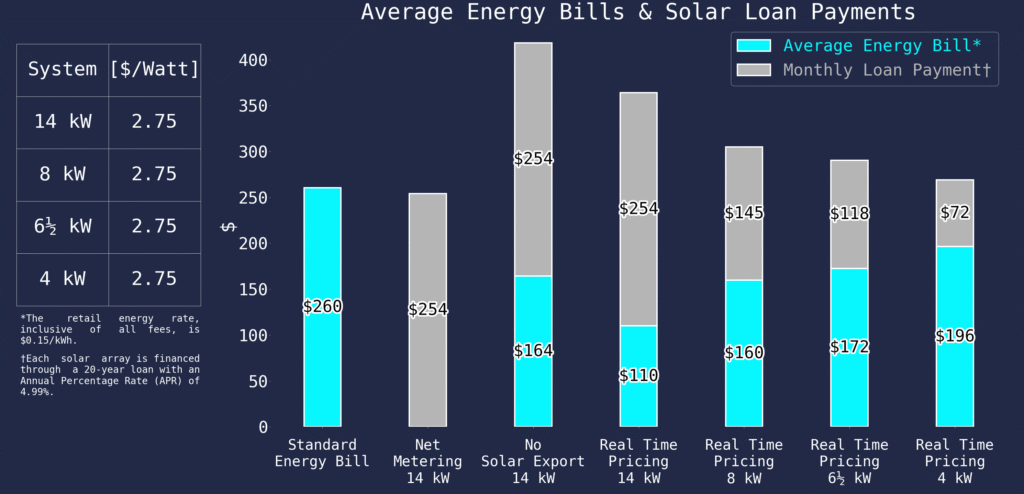

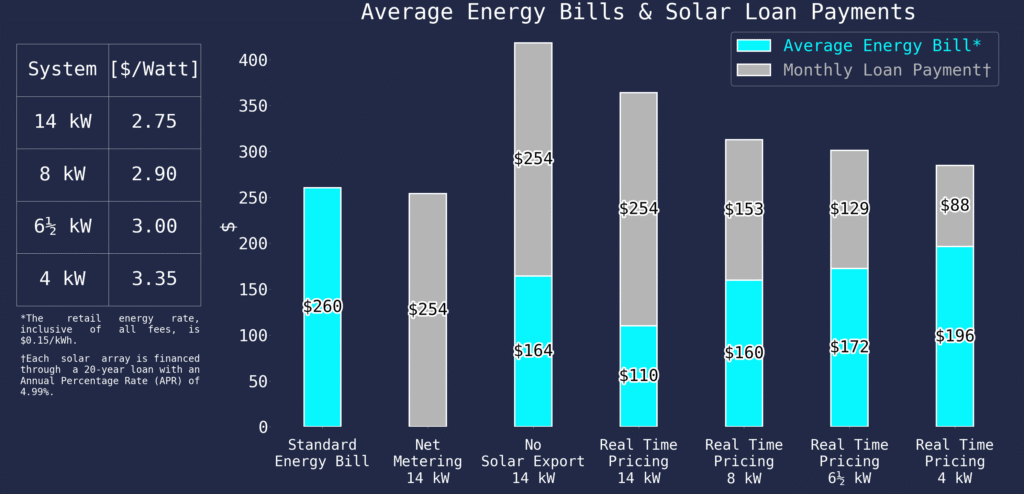

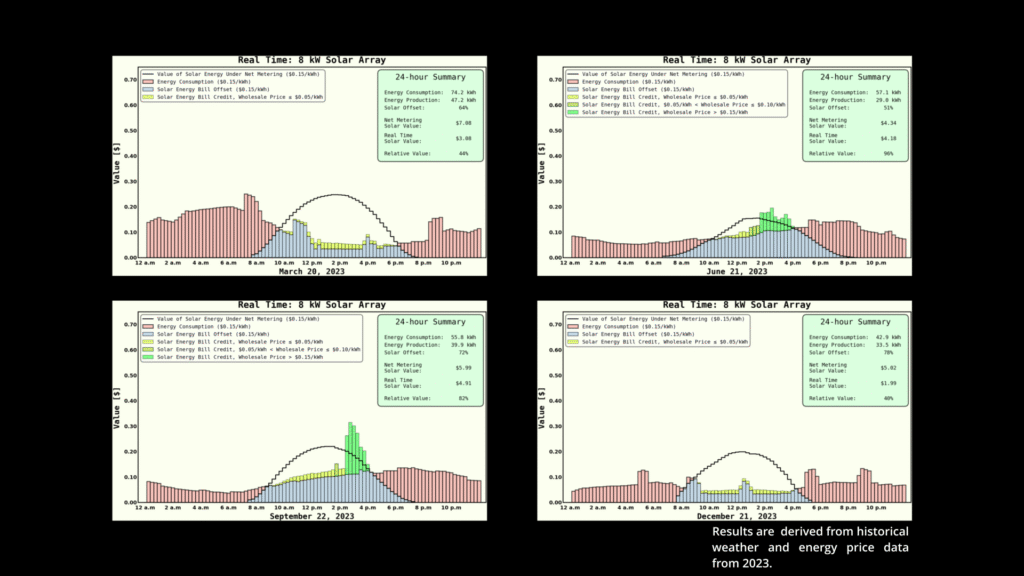

It follows that the customer is still paying 42% of their usual electricity bill, in addition to their solar loan, which is now simply paying for equipment which under-performs from a financial standpoint. Aside from the 14-kW system, let’s consider a smaller (8kW) solar array:

Comparing the 14-kW system to an 8-kW system we see that the 8-kW system produces a higher relative value, except when wholesale prices exceed the retail rate by a considerable amount. This is because a greater proportion of the energy that the 8-kW system produces directly offsets consumption. Looking at the averages for the year, we can see that the 8-kW system has less of an impact on the energy bill, (in part) because less energy is sold at wholesale rates, yet because the loan payment for this smaller system is substantially lower, the overall energy-related expenditures are lower.

We could further optimize the balance between the project cost and the energy bill. However, with smaller arrays, there are fewer panels to share the fixed costs of the installation process; these projects usually have a higher price per watt (PPW), which limits the effectiveness of this strategy.

Conclusion

Based on a year-one analysis, a solar project without net metering is likely to increase overall energy-related expenses.

Why would someone still consider solar if the all-in cost is higher than their current electricity bill? It can provide a hedge against inflation in energy prices in the long run. Another reason is that it facilitates energy storage with batteries as an alternative to installing a generator. This will be discussed in the next article.